The recent short squeeze on hedge fund positions instigated by retail investors on Reddit has garnered many column inches over the last week. However, at Eagle Alpha, we have been helping our clients understand retail investor behaviour for some time now. This week we hosted a series of webinars to share some of our insights into the topic. [Eagle Alpha clients can access a recording of the webinar along with associated decks and write-ups by clicking here.]

Background

Trading by retail investors ramped up in 2020 due to the impact of free trading on the Robinhood financial app. The actions of Robinhood forced US brokers to bring in free trading in 2019. Trading volume accelerated further in 2020 with people working from home due to the Coronavirus pandemic. Trading volumes and the impact it was having on stock prices began to be felt by institutional investors. Hedge funds and other professional investors have been using institutional trade flow data for many years to gain insight into what other market participants were doing. With ever-increasing retail trade volumes, professional investors have been scrambling to gain insight into the impact of these important market participants.

Go With The Flow

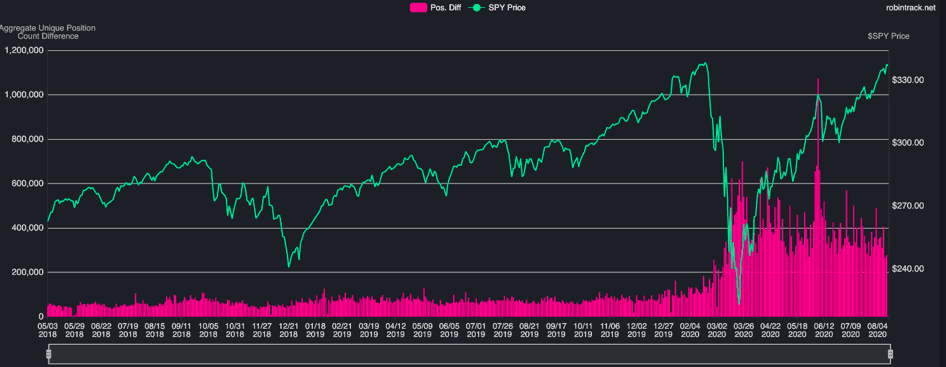

Retail flow data is the most direct approach to tracking the activity of retail traders. Until August of 2020 trading data from Robinhood was freely available through Robinhood’s API. The independent website robintrack.net collected this data and built visualisations to make the data easier for users to interpret. Figure 1 from robintrack.net shows aggregated absolute change in the number of Robinhood users holding the S&P 500 spider versus the price of the spider. Although the data has been pulled, Robinhood has indicated they are interested in bringing back the data in some form at some point in the future, but no details have been shared. We will be watching this space closely.

Figure 1: Aggregated absolute change in the number of Robinhood users holding the S&P 500 spider versus the price of the spider.

Figure 1: Aggregated absolute change in the number of Robinhood users holding the S&P 500 spider versus the price of the spider.

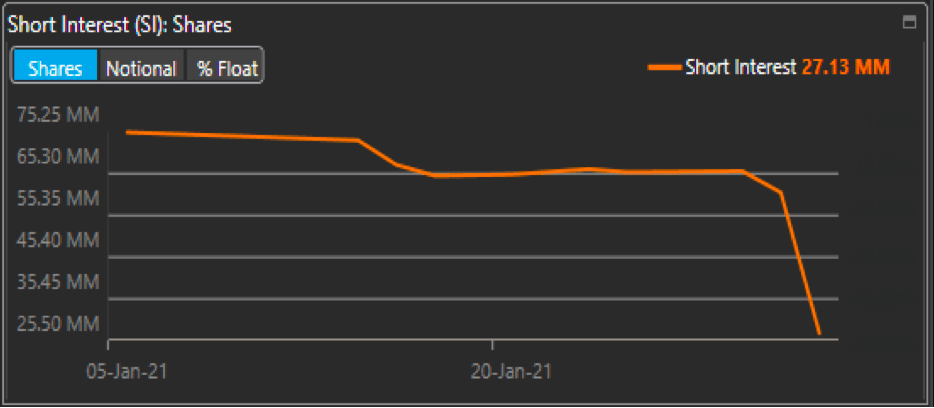

From the time that Robintrack data was discontinued in August 2020, Eagle Alpha has been fielding calls from clients on ways to track retail investor activity. Other forms of flow data can be recommended and short interest is a type of flow data that can be instructive in the current environment. One vendor on our webinar this week highlighted flaws in the traditional short interest metric used widely in the market. In the media frenzy, Gamestop’s short interest was reported as 120-140% of the float. This metric is flawed because in order to short a stock you must first borrow the stock from someone who owns it. The subsequent sale creates a synthetic long. The traditional calculation does not include the synthetic long’s that are trading in the market. Adjusting for this gives a Gamestop short interest number closer to 55%. This provides investors with a clearer picture of market dynamics and the true liquidity of the stock. Using this short interest data it was possible to get ahead of the later part of the short squeeze in GameStop. Indeed, on 25th January the vendor had highlighted a buying rally in GameStop, signalling danger for short-sellers and opportunity for buyers (figure 2).

Figure 2: Buying rally in GameStop, signalling danger for short-sellers and opportunity for buyers.

Figure 2: Buying rally in GameStop, signalling danger for short-sellers and opportunity for buyers.

Another area of interest highlighted on the webinar is data tracking the flow of institutional money into globally domiciled ETF’s and mutual funds. Institutional flow data is already being used by many hedge funds and quants but now needs to be supplemented with retail flows.

However valuable the flow and short interest data are, it does not speak directly to the potential activity of retail traders in advance of any actual trading in individual stocks. Since Robinhood discontinued their data feed several other trading platforms have considered monetizing their data but have been more hesitant due to the risk of bad publicity. As a result, we are forced to look elsewhere to track this segment of the market…

Online Chatter

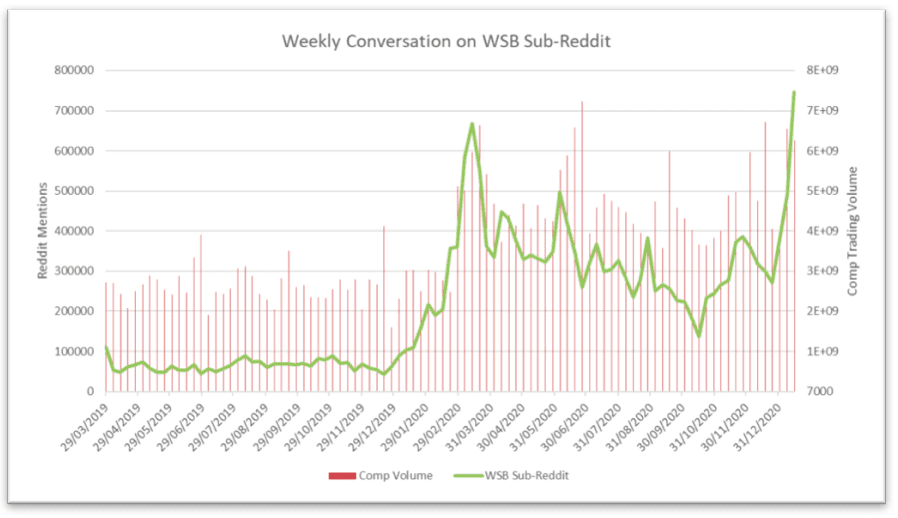

Beyond flow data, one of the most popular approaches to tracking retail investors is the analysis of online conversations. Eagle Alpha analyst Brendan Furlong shared some of his work on the topic this week. He presented the analysis of retail investor conversation, or chatter, on Reddit and Twitter using Eagle Alpha’s social media analytics tool. He demonstrated the linkage between trading volume on the Nasdaq Composite (Comp) and conversation from the Wallstreetbets sub-Reddit and mentions of key retail trader terms on Twitter. It’s noteworthy that chatter has more of a relationship with trading volume than price (figure 3).

Figure 3: Weekly conversations on the WallStreetBets sub-Reddit.

Figure 3: Weekly conversations on the WallStreetBets sub-Reddit.

In addition to Brendan’s work, we also featured several other vendors who provide similar insights into the online conversations by retail investors. They have been monitoring increased crypto and stock chatter in recent times, even on forums and sites that would not usually have this type of content. In many instances, these datasets are seen as risk management tools, particularly for hedge funds that have a long/short portfolio.

Other Approaches

Over the week we also featured several other speakers and vendors highlighting data that could be valuable for tracking retail investor activity:

- Web traffic is useful to understand if the online chatter is in fact translating into activity. It is possible to track the activity on trading websites, including tracking which individual stocks users are viewing. This has demonstrated some relationship with stock trading volumes. This data also indicates what platforms are proving most popular. For example, Robinhood has risen from around 10% share in 2020 to around 35% in January this year.

- App data can be used to measure downloads of financial apps like Robinhood for tracking the growth of retail traders. Over the course of the Gamestop short squeeze, Robinhood has become the number one financial app in the US. However, ratings for the app have recently turned very negative because of Robinhood’s decision to suspend trading in several heavily traded stocks.

- Google Trends is useful for tracking consumer behaviour and Eagle Alpha provide a tool for performing a systematic search on Google for companies and tickers. The Search Management Tool can normalize for peak mentions and adjust hourly and daily mentions to weekly and monthly times series plots for backtesting.

A Legal Perspective

We also had Peter Green, partner & vice-chair of the investment management group at Lowenstein Sandler join us this week. Peter is not convinced that there is a market manipulation case to be made against the retail investors in this case. He pointed out that everything they say (on Reddit) is transparent and truthful, so it seems like an uphill climb for an SEC fraud case based on misinformation.

On the subject of the class-action lawsuit against Robinhood, Peter seemed unconvinced of the merit of the action given Robinhood’s claim that they needed to slow down trading in certain stocks in order to meet their capital requirements with the clearinghouses.

In terms of the legality of the data sources being used, Reddit is a public site and so Peter believes it is okay from a material non-public information (MNPI) perspective.

While Peter doesn’t see direct legal implications of the Reddit short squeeze, he is convinced that the event will bring in reform and new regulations. He thinks Congress could step in with reform and regulation to prevent this from ever happening again.

Conclusions

The Reddit short squeeze has brought the actions of retail investors into sharp focus. At Eagle Alpha, we have been helping our clients understand retail investing trends for some time and this proved invaluable in the current environment. Flow data is an obvious place to start, and while there are certainly valuable insights there, flow data alone doesn’t provide a complete picture. Complementing the data with other sources such as crawled web data, app data, web traffic and online search activity provides a much more rounded view on the topic. Combining these datasets can help investors spot new opportunities or manage the downside risk from the increased participation from retail investors in the market.

There doesn’t appear to be any direct legal implications of the activity of recent weeks, but it does seem likely the regulators or legislators will step in to prevent something similar recurring. This could have lasting implications for all market participants, both retail and institutional.

[If you would like to learn more about any of the data sources mentioned or how Eagle Alpha is helping clients in the current environment then please contact us at inquiries@eaglealpha.com]