The Rise in Alternative Data for Crypto Investors

Cryptocurrency, or “crypto” as it has become widely referred to, has been one of the quickest-moving trends in the investment space of late, with retail and institutional investors throwing their hats in the ring.

In a recent conversation with Netherlands-based cryptocurrency manager Hodl.nl, the team stated, “The digital revolution is currently shaking the world to its foundations.” The ecosystem has a vast stream of data available to its participants.

While traditional markets must obtain all their information from external entities, through conventional channels like Bloomberg or via alternative sources such as satellite and geolocation, cryptocurrency provides the opportunity to also look at global internal data. Thanks to blockchain technology, you can get real-time statistics for anything on-chain.

Hodl.nl explained that you could directly measure on-chain sentiment and combine that data with sentiment based on traditional trading markets’ external sources. You can also closely monitor which traders are making moves during particular market sentiments. The transparency of the blockchain gives an extra dimension to market movements that the right analytical tools can closely follow.

Bartt Kellermann, Founder of Battle of the Quants, provided us with his take on the rise of alternative data for crypto. He said, “The proliferation of crypto funds continues and has become the hottest sector within the hedge fund space. Managing a hedge fund without a crypto fund is like managing a car company without an electric car.”

Bartt will take to the stage on April 6th to host a crypto-focused panel titled “Russian War Sanctions to Future Trends in Digital Currency Adoption” at Eagle Alpha’s UNBOUND Conference in New York. Bartt will be joined by expert speakers from Kaiko, One River Asset Management, and Belobaba Crypto Asset Fund. You can register to attend here.

There are three primary alternative sources for crypto markets available to investors: Trading datasets focused on flow and tick data, market sentiment, and event-risk data. This article provides a breakdown of each with relevant use cases alongside. For more information on accessing further research and information on the data providers on our platform, please reach out to dallan.ryan@eaglealpha.com.

Trading (Flow and Tick) Datasets

Flow and tick datasets monitor and provide essential information in the market on where the currency is moving from, where it is moving to, and details the published prices of the crypto. Flow and tick datasets provide timely information on volume, market volatility, historical pricing, and more for these markets.

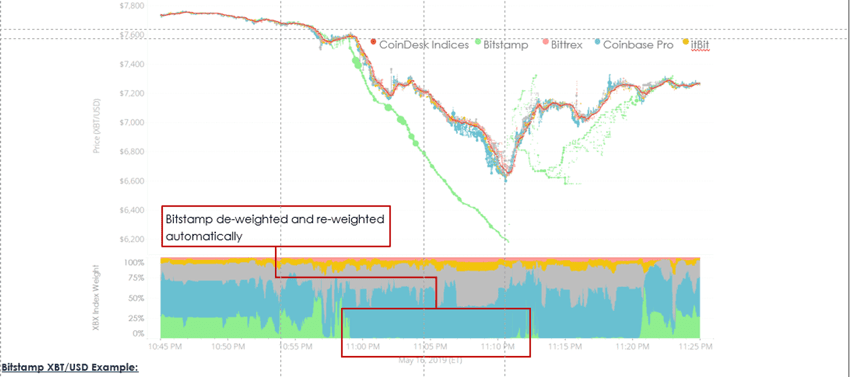

Since data integrity is paramount in crypto, alternative data insights provide institutional investors price stability during major exchange outages. Figure 1 illustrates the real-time data monitoring of a momentary crash on the XBT/USD Bitstamp exchange showing the pairing drop by 20%.

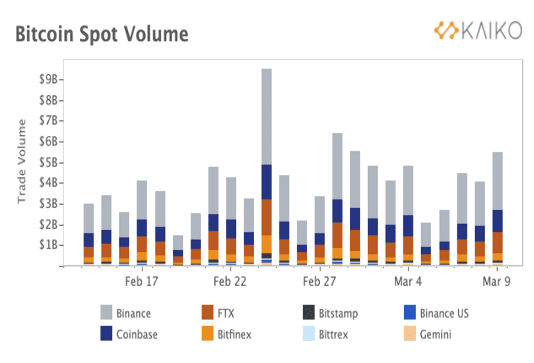

Kaiko’s data in figure 2 illustrates how leading alternative data providers enable traders to monitor volume at the instrument level and include every executed transaction on all exchanges in their coverage. Their data also highlights how order book data enables traders to monitor spreads, depth, and slippage across exchanges.

Sentiment Data

Using Natural Language Processing (NLP) and data analysis of crypto discussions taking place on social media and other online forums, investors can get a glimpse into the mind of traders and obtain insight through sentiment. Sentiment datasets determine whether online users indicate positive or negative feelings towards specific cryptocurrencies and can be used to predict upcoming events before they appear in the broader market. For example, sentiment can provide indications of a crash and, similarly, a bull run, based on user discussion.

Based on Twitter activity discussing Bitcoin, sentiment-based datasets can analyze bullish and bearish tweets and mentions to provide market signals to traders. Signals can point towards a higher volume of bullish tweets during the rise in Bitcoin prices and a drop in bullish tweets during the fall in price.

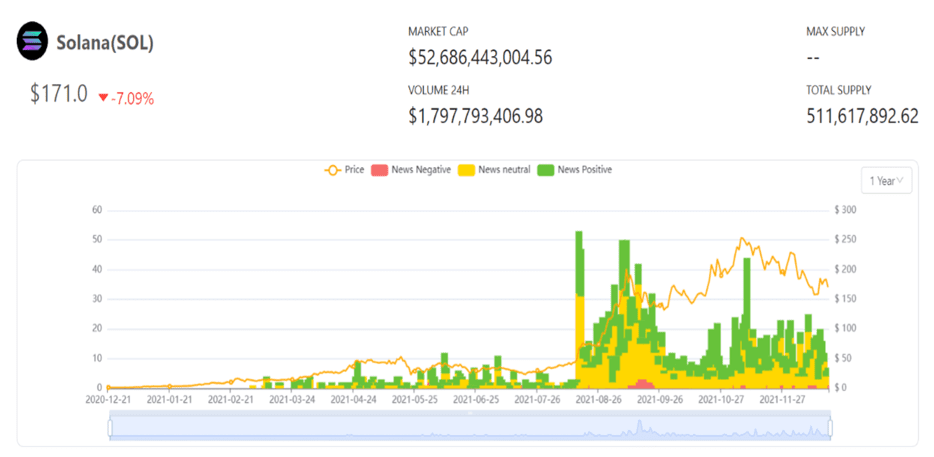

Data from ORBIT (figure 3) illustrates how vendors can derive sentiment from news to screen coins and generate trading signals. This analysis is completed using AI & NLP techniques through topic detection on coins’ whitepapers to support crypto index development.

Event Risk Datasets

Event detection, like sentiment, provides a predictive quality for crypto markets by forecasting a market event before it occurs. Since the crypto market is highly topical and in the line of sight of both media and regulatory organizations, being aware of risks associated with external events can be helpful when navigating a constantly evolving market.

BCMstrategy uses advanced analytics to measure momentum towards a decision, enabling users to “catch the wave” before the headlines hit. The data finds and measures the developments that will appear later in news aggregation feeds, institutional news feeds, and email newsletters.

Since BCMstategy’s alerts are generated when policymakers act, the latency for price action can be considerable, providing portfolio managers with the opportunity to scan news feeds. Portfolio managers with highly developed portfolio theses can pre-program alerts as trading signals for individual assets or baskets of assets. High volatility can generate negative signals for certain issuers/assets (e.g., cryptocurrency issuers, the Russian Ruble) and positive signals for others (e.g., regulated bank stable coin issuers, the Dollar).

Conclusion

As illustrated through a range of use cases across trade, sentiment, and event risk datasets, there is a rich amount of information related to crypto markets. We expect many more data providers to establish themselves over the coming year. Our full report highlights the complete list of current leaders in the space alongside use cases and dataset insights. Please reach out to dallan.ryan@eaglealpha.com for more information.