Real estate has long been a cornerstone of diversified investment portfolios, offering the potential for income and capital appreciation and there is now even more potential for using alternative data in real estate investment. David Rovella at Bloomberg recently stated that US regional banks face potential failures due to high concentrations of troubled commercial real estate loans and the distress is just beginning, illustrating why alternative data is more important than ever for tracking this .

The landscape of real estate investment is evolving rapidly, driven by alternative data sources that provide deeper insights and predictive power. For analysts and portfolio managers, leveraging alternative data is becoming essential to stay ahead of market trends and maximize returns. Over the years, we have hosted several workshops related to real estate like our recent 2024 China real estate update, and published investor reports like the alternative data for real estate highlighting key case studies and data vendors.

The Rise of Alternative Data in Real Estate Investment

The traditional approach to real estate investment involves extensive research, historical data analysis, and market trend evaluation. However, these methods often lag behind real-time market dynamics. Alternative data, encompassing non-traditional data sources such as satellite imagery, web-crawled data, and user-generated content, is revolutionizing the way investors analyze and predict real estate trends.

Key Trends Influenced by Alternative Data

Retail and Commercial Real Estate

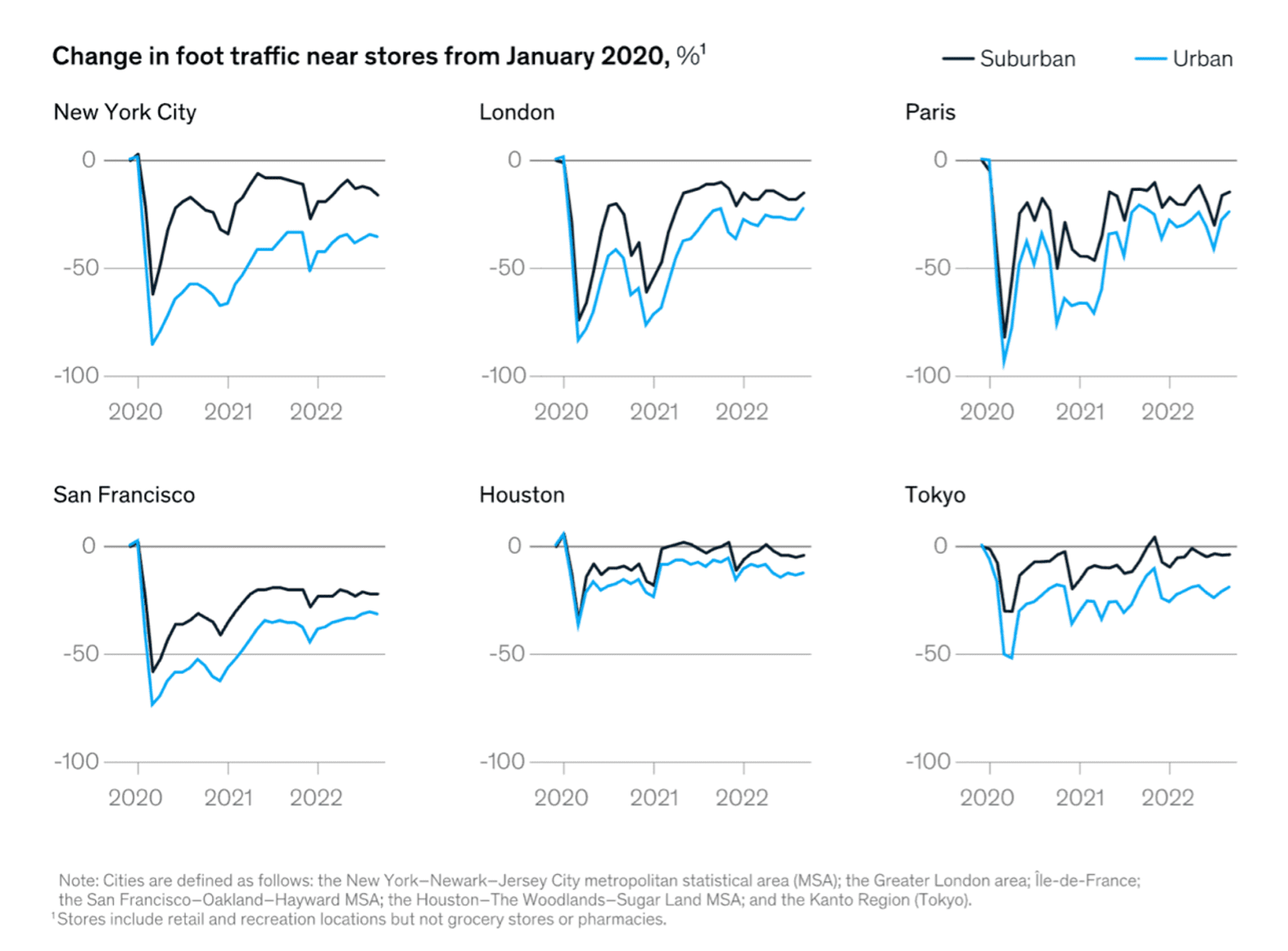

The shift towards e-commerce has impacted urban retail spaces. Despite some recovery, foot traffic near metropolitan stores remains lower than pre-pandemic levels. Alternative data helps in tracking these trends, providing granular insights into consumer behavior and commercial space utilization.

Urban Migration Patterns

The COVID-19 pandemic drastically altered urban landscapes. Many companies shifted to remote work, leading to a significant out-migration from urban centers to suburbs and other cities. Data from sources like McKinsey reveal that cities like London, Dallas, and New York experienced major declines in foot traffic and office space demand, while suburban areas saw a rise in homeownership prospects and outdoor space demand.

Figure 1: Foot Traffic Near Stores is Recovering More Quickly in the Suburbs than in Urban Areas (Source: McKinsey)

Gentrification and Neighborhood Dynamics

Academic studies have demonstrated the utility of alternative data in understanding neighborhood gentrification. Data from platforms like Yelp and Airbnb can reveal changes in local business landscapes and housing affordability, offering real-time indicators of socio-economic shifts.

Utilizing Alternative Data for Real Estate Investment

Predictive Analytics

Tools like Google Trends can nowcast building permits, serving as leading indicators for construction-related economic activities. These predictive analytics enable investors to anticipate market movements and adjust strategies accordingly.

Real-Time Monitoring

Platforms such as DeepMacro and SpaceKnow leverage satellite imagery and web-crawled data to provide real-time updates on global economic conditions and specific real estate developments. This data is invaluable for monitoring ongoing projects and market health.

Risk Assessment

Advanced risk analytics tools, like those from Athenium, offer insights into natural hazard risks. These tools help investors assess the vulnerability of properties to climate-related events, ensuring informed decision-making.

Case Study On Alternative Data For Real Estate Investment In Action

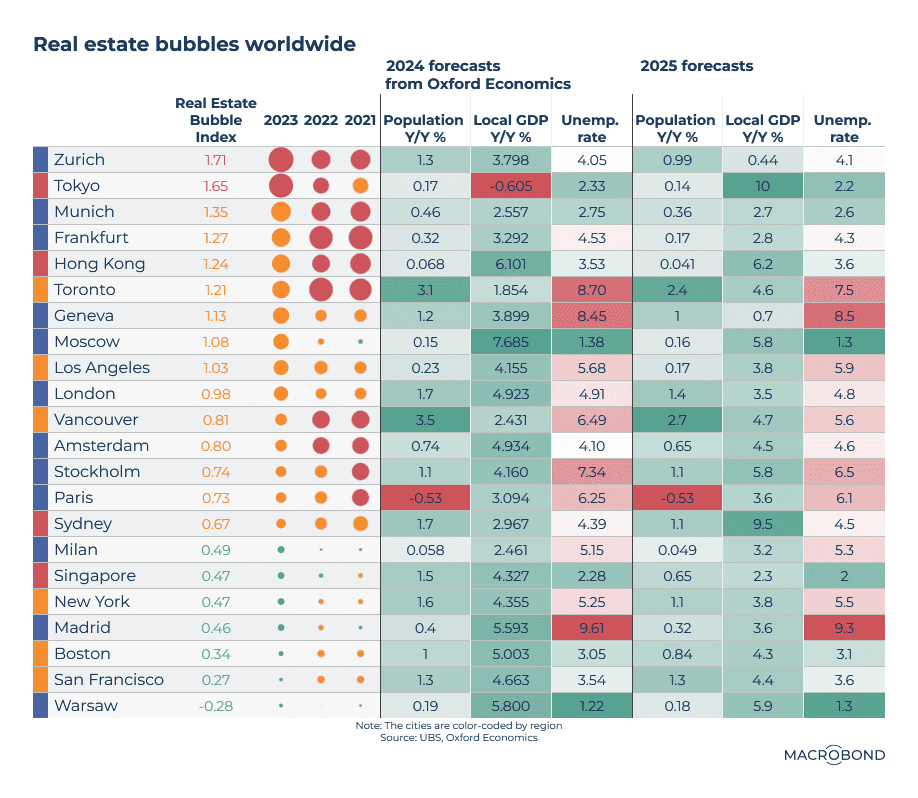

In October 2023, we published a report breaking down recent trends, academic research, leading alternative data vendors, and case studies for the real estate market. One of the case studies highlighted in this deck is macroeconomic forecasts from Macrobond.

Macrobond

Macrobond Financial is the world’s largest macroeconomic and top-down financial database with over 300 million time series collected from over 2,400 national and international sources. Time series are categorized into 24 proprietary themes, such as balance of payment, financial accounts, and foreign finance. The database covers per city, state, or region time series with over 422 defined countries and regions.

Macrobond partnered with Oxford Economics, a leading independent economic advisory firm, in real estate forecasting. Figure 2 shows an analysis based on a combination of the UBS Global Real Estate Bubble Index and macroeconomic indicators from Oxford Economics for selected metropolitan areas. The UBS index categorizes markets as depressed, undervalued, fairly valued, overvalued, or in a bubble based on their ratings, with values above 1.5 indicating a bubble. German-speaking regions of Europe and Canada’s largest cities rank high on this index, while major U.S. cities are still relatively undervalued, despite recent increases in house prices.

We have asked Macrobond for an updated version of this chart and obtained the continuously updated version below, including forecasts for 2025

Figure 2: Real Estate Bubbles Worldwide (Source: Macrobond)

Conclusion

The COVID-19 pandemic has significantly reshaped the real estate market, prompting a shift away from traditional urban offices towards remote work and suburban living. This has led to increased vacancies in urban office and retail spaces and slower home price growth in metropolitan areas.

Despite some recovery in physical store foot traffic, urban retailers continue to face challenges due to the sustained popularity of online shopping. Various alternative datasets, including macroeconomic indicators, web-crawled data, and satellite imagery, are becoming crucial for analyzing market trends and making informed investment decisions.

Investing in the future of real estate with alternative data will help investors to stay ahead of the curve.