Mapping Data to Symbols and Tickers: Best Practices for Data Vendors

In the financial industry, accurately mapping data to identifiers, symbols, or tickers is crucial. This process ensures data consistency, enhances reliability, and facilitates seamless data integration across various platforms. For data vendors, implementing effective mapping strategies significantly improves data usability and client satisfaction. Even more importantly a majority of financial institutions require datasets to be mapped before even considering purchasing the alternative data. Even when mapping is not a requirement, funds prefer mapped datasets as it makes it easier for them to wrangle and backtest and it, therefore, increases the marketability and value of your data offering.

Understanding Financial Identifiers

Financial identifiers serve as the backbone for data organization, uniquely representing financial instruments across global markets. Ticker symbols, such as Apple’s ‘AAPL’, provide codes for cleaning data, for ETL, backtesting securities and trading. Other widely-used identifiers include the International Securities Identification Number (ISIN), which uniquely distinguishes global securities, and the CUSIP, primarily used in North American markets to identify stocks, bonds, and other financial instruments. The Financial Instrument Global Identifier (FIGI) is another important global standard that ensures clarity across diverse market systems and asset classes.

– Ticker Symbols: Short codes assigned to securities for trading purposes. For example, Apple’s ticker is AAPL.

– ISIN (International Securities Identification Number): A 12-character code that uniquely identifies securities, such as bonds and stocks.

– CUSIP (Committee on Uniform Securities Identification Procedures): A 9-character alphanumeric code identifying North American securities.

– OpenFIGI (Financial Instrument Global Identifier): A globally recognized standard for identifying financial instruments across markets and asset classes.

As well as this, and depending on the type of data you offer, it could be important to map your data to countries, regions, private companies, etc.

One thing vendors need to be aware of with these identifiers is the potential cost of using these symbologies. There is a licensing cost to using ISIN and CUSIP. OpenFIGI should be explored as a more cost-effective solution.

Importance of Accurate Data Mapping

Accurate data mapping to identifiers is fundamental for data integration and operational efficiency. Reliable mapping enables financial firms to consolidate data from multiple sources efficiently, reducing the time and resources needed for data reconciliation. Additionally, accurate mapping is essential for effective risk management, as firms can precisely track securities exposures and implement timely risk mitigation strategies. Regulatory compliance further underscores the necessity of accurate mapping; errors in identifier mapping could potentially lead to trading errors, regulatory fines, operational setbacks, and reputational damage.

Best Practices for Effective Data Mapping

Adopting standardized identifiers such as ISINs, FIGIs, and CUSIPs is essential for maintaining uniformity across datasets. These standards facilitate clear communication among financial institutions globally. Employing robust algorithms enhances mapping accuracy, allowing data from various sources to align correctly even when formats differ. Algorithms should leverage techniques like fuzzy matching to manage discrepancies and minor variations effectively.

Regularly updating reference data is also crucial, particularly given frequent changes such as mergers, acquisitions, and ticker symbol reassignments. Maintaining an updated reference database helps ensure data integrity and accuracy over time. Using mapping APIs provided by specialized services can simplify the integration process, enabling rapid resolution of identifiers and significantly streamlining data management tasks.

So to recap:

- Utilize Standardized Identifiers: Adopt globally recognized identifiers like ISINs and FIGIs to maintain uniformity.

- Implement Robust Mapping Algorithms: Develop algorithms capable of matching data fields accurately, even when dealing with diverse data sources.

- Maintain Updated Reference Data: Regularly update reference data to reflect changes such as mergers or ticker symbol alterations.

- Leverage Mapping APIs: Use APIs that resolve various identifiers to standardized company details, facilitating accurate mapping.

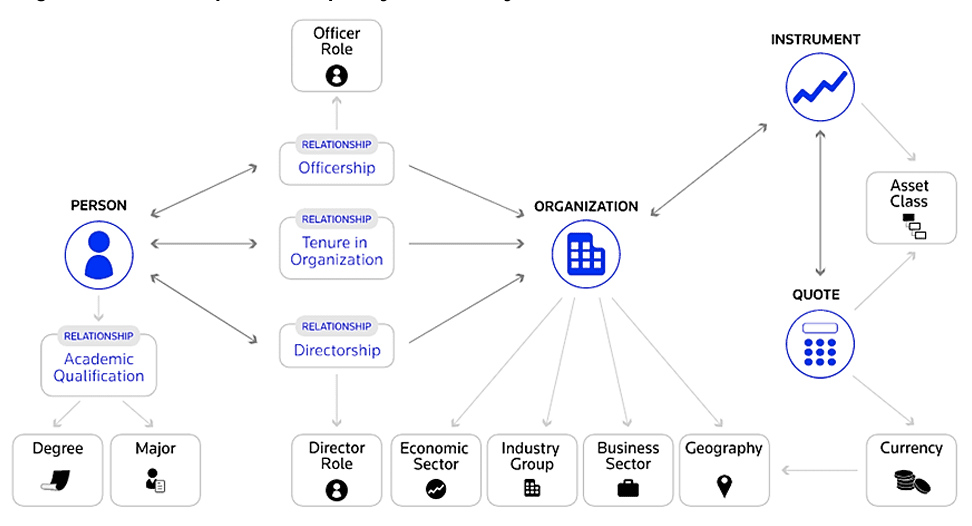

Mapping Ecosystem. Source: permid.org / Refinitiv

Overcoming Common Data Mapping Challenges

Despite best practices, financial data mapping can be complex, often involving diverse data formats and inconsistent data sources. One common challenge is integrating data with legacy systems, which may use outdated or proprietary formats. Overcoming these challenges requires adopting flexible, scalable solutions capable of accommodating various data standards and ensuring compatibility.

Data quality issues, such as incomplete datasets or inconsistent naming conventions, frequently arise. To address these, organizations must prioritize data validation and cleansing processes. Continuous monitoring and quality checks can identify and resolve issues proactively, enhancing overall dataset reliability.

Leveraging Modern Tools and Techniques

Advancements in technology offer powerful tools for addressing data mapping complexities. Machine learning (ML) and Natural Language Processing (NLP) techniques significantly improve named entity recognition (NER), aiding in the accurate linking of entities to their respective financial identifiers. The advent of LLM’s like Open AI has made NER even more efficient. Technology providers increasingly offer automated and semi-automated solutions that reduce manual workload and improve accuracy.

Incorporating modern data visualization and monitoring tools also allows for easier detection of anomalies or mapping errors, helping vendors quickly identify and correct issues. Vendors can further optimize their processes by partnering with specialized technology solution providers experienced in handling financial identifiers and data mapping.

Conclusion

For data vendors, accurately mapping data to identifiers, symbols, or tickers is essential for successful data integration, client satisfaction and to increase the uniqueness and value of data. It will ultimately make the data an “easier sell” to financial institutions.

Implementing best practices, leveraging advanced technology, and continuously refining mapping strategies will enhance data accuracy, streamline operations, and drive competitive advantage in the rapidly evolving financial data market.

You can learn more about how to monetize your data by reading our data vendor ultimate guide.

If you are looking to map your datasets and are trying to source a 3rd party solution, please reach out and we can help you get your data mapped.