Welcome to Eagle Alpha's Alternative Data Conference New York

12th February 2025 View AgendaView Venue MapWe’re delighted to have you join us in New York for a day of thought-provoking discussions, industry insights, and invaluable networking opportunities. This year’s agenda is packed with expert-led sessions, cutting-edge data trends, and the introduction of our brand-new Explorer Hub, where you can discover innovative, new-to-market vendors.

Whether you’re here to explore the latest in alternative data, connect with peers, or gain actionable insights, we hope you make the most of your time with us. Thank you for being part of the conversation—enjoy the conference!

Agenda – Wednesday, February 12th 2025

08:00am - 8:45am

Gallery

Registration

08:50am - 9:00am

Main Room

Welcome & Opening Statements

Michael Finnegan, CEO of Eagle Alpha

Join us for the official kickoff of the Eagle Alpha Alternative Data Conference with a Welcome & Opening Remarks led by CEO, Michael Finnegan.

9:00am - 9:30am

Main Room

Engineering Tomorrow’s Hedge Fund Technology: Avoiding Data Infrastructure Lock-in and Deploying Useful AI Applications

With Michael Watson, Hedgineer in conversation with Thomas Combes, Eagle Alpha

Join us for a discussion with Michael Watson, founder of Hedgineer, on the future of hedge fund technology. We’ll explore how open table formats and hybrid compute engines can prevent data infrastructure lock-in, and delve into real-world applications of AI that are transforming how hedge funds operate.

9:15am - 9:45am

Breakout Room

Private Equity Track – How Investors and Lenders in Private Companies are Using Technology & Analytics as a Competitive Weapon

With David Teten, Versatile VC

Explore the current state of alternative data adoption in the PE/VC industry with practitioners who are actively using these data sources. This session will provide a firsthand look at how firms are integrating alternative data into their investment strategies.

9:30am - 10:30am

Main Room

New to Market & Fresh Features – Vendor Presentations

An exciting session where we’ll dive into the latest advancements and features from top data vendors.

9:45am - 10:00am

Breakout Room

Private Equity Track – The Fund of the Future: Embracing Technology and Data in Private Equity with West Monroe

With Brad Heller, West Monroe

Explore how private equity firms can leverage technology, data analytics, and innovation to gain a competitive edge. West Monroe will break down the “Fund of the Future” framework, offering strategies to drive growth, efficiency, and value creation in today’s evolving market.

10:00am - 10:30am

Breakout Room

Private Equity Track – Alternative Data and Private Equity – Use Cases and Applications

With Claire McCarthy, G2, Wayne Norris, Dodge Construction Data and Shameel Abdulla, Clootrack, moderated Brendan Furlong, Eagle Alpha

Join leading data vendors for a panel discussion on how alternative data is transforming the private equity landscape, with a focus on real-world applications and actionable strategies.

10:30am - 12:00pm

Gallery

1-1 Meetings

Schedule one-on-one meetings with vendors to discuss specific requirements and learn more about their products and services. Discover new vendors in our Explorer Hub, featuring completely new-to-market vendors revealed exclusively on the day of the conference.

12:00pm - 12:30pm

Main Room

Consumer Insights and Product Developments from Leading Vendors

With Brian Callahan, Facteus, Thomas Grant, Apptopia and Alex Nisenzon, Charm.io, moderated by Brendan Furlong, Eagle Alpha

Gain valuable insights into consumer behavior and witness the latest product innovations as a panel of leading vendors share their expertise. This interactive session will explore the intersection of consumer needs and cutting-edge product development.

12:00pm - 12:30pm

Breakout Room

Private Equity Track – Fireside Chat: Value Creation Themes: Talent, Revenue, Operations

With Tom Liu, Managing Partner / Founder of Ideate Capital in conversation with Conor Taggart, Eagle Alpha

Join us for a fireside chat with a former Head of Data at a top private equity firm as we dive into the cutting edge of value creation. We’ll explore how top firms are securing elite talent, leveraging enriched data to drive higher close rates, and harnessing LLMs to optimize every stage of the deal cycle—from sourcing to contract execution.

12:30pm - 1:00pm

Gallery

Networking Lunch

1:00pm - 1:20pm

Main Room

In Pursuit of Alpha: With Bloomberg Research Data for Systematic Research and A.I Workflows

With Michael Beal, Bloomberg

Michael will explore how Bloomberg Research Data is driving quantitative research, AI applications, and alpha generation, helping investors integrate cutting-edge data into systematic workflows.

1:20pm - 2:00pm

Main Room

The Opportunities And Nuances of Deploying Unstructured Data In Quant Trading Models

With Professor Francesco Fabozzi, Yale University, Didier Lopez, OpenBB and Dan Joldzic, Alexandria Technology, moderated by Christos Koutsoyannis, Atlas Ridge Capital.

Join leading practitioners for a discussion on the practical applications of unstructured data in quant trading. This session will address the opportunities and nuances of deploying these models, including data sourcing, processing, and integration.

2:00pm - 3:30pm

Gallery

1-1 Meetings

Schedule one-on-one meetings with vendors to discuss specific requirements and learn more about their products and services. Discover new vendors in our Explorer Hub, featuring completely new-to-market vendors revealed exclusively on the day of the conference.

3:30pm - 4:00pm

Main Room

2025 Compliance: What to Expect from the New Administration

With Sergio Pagliery, Schulte Roth & Zabel and Emilie Abate, Iron Road Partners, moderated by Ciaran Ryan, Eagle Alpha

4:00pm - 4:30pm

Main Room

Alien Intelligence, Myth and Reality

With Frederic Siboulet, consultant (former Deloitte, EY & IBM)

Over the past three years, there has been a rapid acceleration in the role of artificial intelligence, particularly with GPTs and LLMs. We examine why, how, and where AI may be augmenting human performance in quantitative and operational tasks. We also consider how this new paradigm relates to model structures and data utilization, both during training and inference. In addition, we discuss the relationship between model size and model risk, and explore the potential evolution of data science given the new agentic frameworks available to businesses.

4:30pm - 5:00pm

Main Room

Uncorking Alpha: Data-Driven Strategies in Fine Wine Investing

With Tommy Jensen, Wine Capital Fund in conversation with Ciaran Ryan, Eagle Alpha

Data driven wine investing? Yes please. Join Tommy Nordam Jensen (CEO, Wine Capital) and Ciaran Ryan as they discuss Selection, Storage and Selling of tier 1 investment grade wines.

5:00pm - 6:00pm

Gallery

Drinks Reception

Wind down after the conference and connect with colleagues at our closing social gathering.

6:00pm

Invite Only Buyer Dinner and Networking

Agenda – Wednesday, February 12th 2025

Registration

08:00am - 8:45am

Gallery

Welcome & Opening Statements

Michael Finnegan, CEO of Eagle Alpha

Join us for the official kickoff of the Eagle Alpha Alternative Data Conference with a Welcome & Opening Remarks led by CEO, Michael Finnegan.

08:50am - 9:00am

Main Room

Engineering Tomorrow’s Hedge Fund Technology: Avoiding Data Infrastructure Lock-in and Deploying Useful AI Applications

With Michael Watson, Hedgineer in conversation with Thomas Combes, Eagle Alpha

Join us for a discussion with Michael Watson, founder of Hedgineer, on the future of hedge fund technology. We’ll explore how open table formats and hybrid compute engines can prevent data infrastructure lock-in, and delve into real-world applications of AI that are transforming how hedge funds operate.

9:00am - 9:30am

Main Room

Private Equity Track – How Investors and Lenders in Private Companies are Using Technology & Analytics as a Competitive Weapon

With David Teten, Versatile VC

Explore the current state of alternative data adoption in the PE/VC industry with practitioners who are actively using these data sources. This session will provide a firsthand look at how firms are integrating alternative data into their investment strategies.

9:15am - 9:45am

Breakout Room

New to Market & Fresh Features – Vendor Presentations

An exciting session where we’ll dive into the latest advancements and features from top data vendors.

9:30am - 10:30am

Main Room

Private Equity Track – The Fund of the Future: Embracing Technology and Data in Private Equity with West Monroe

With Brad Heller, West Monroe

Explore how private equity firms can leverage technology, data analytics, and innovation to gain a competitive edge. West Monroe will break down the “Fund of the Future” framework, offering strategies to drive growth, efficiency, and value creation in today’s evolving market.

9:45am - 10:00am

Breakout Room

Private Equity Track – Alternative Data and Private Equity – Use Cases and Applications

With Claire McCarthy, G2, Wayne Norris, Dodge Construction Data and Shameel Abdulla, Clootrack, moderated Brendan Furlong, Eagle Alpha

Join leading data vendors for a panel discussion on how alternative data is transforming the private equity landscape, with a focus on real-world applications and actionable strategies.

10:00am - 10:30am

Breakout Room

1-1 Meetings

10:30am - 12:00pm

Gallery

Consumer Insights and Product Developments from Leading Vendors

With Brian Callahan, Facteus, Thomas Grant, Apptopia and Alex Nisenzon, Charm.io, moderated by Brendan Furlong, Eagle Alpha

Gain valuable insights into consumer behavior and witness the latest product innovations as a panel of leading vendors share their expertise. This interactive session will explore the intersection of consumer needs and cutting-edge product development.

12:00pm - 12:30pm

Main Room

Private Equity Track – Fireside Chat: Value Creation Themes: Talent, Revenue, Operations

With Tom Liu, Managing Partner / Founder of Ideate Capital in conversation with Conor Taggart, Eagle Alpha

Join us for a fireside chat with a former Head of Data at a top private equity firm as we dive into the cutting edge of value creation. We’ll explore how top firms are securing elite talent, leveraging enriched data to drive higher close rates, and harnessing LLMs to optimize every stage of the deal cycle—from sourcing to contract execution.

12:00pm - 12:30pm

Breakout Room

Networking Lunch

12:30pm - 1:00pm

Gallery

In Pursuit of Alpha: With Bloomberg Research Data for Systematic Research and A.I Workflows

With Michael Beal, Bloomberg

Michael will explore how Bloomberg Research Data is driving quantitative research, AI applications, and alpha generation, helping investors integrate cutting-edge data into systematic workflows.

1:00pm - 1:20pm

Main Room

The Opportunities And Nuances of Deploying Unstructured Data In Quant Trading Models

With Professor Francesco Fabozzi, Yale University, Didier Lopez, OpenBB and Dan Joldzic, Alexandria Technology, moderated by Christos Koutsoyannis, Atlas Ridge Capital.

Join leading practitioners for a discussion on the practical applications of unstructured data in quant trading. This session will address the opportunities and nuances of deploying these models, including data sourcing, processing, and integration.

1:20pm - 2:00pm

Main Room

1-1 Meetings

2:00pm - 3:30pm

Gallery

2025 Compliance: What to Expect from the New Administration

With Sergio Pagliery, Schulte Roth & Zabel and Emilie Abate, Iron Road Partners, moderated by Ciaran Ryan, Eagle Alpha

3:30pm - 4:00pm

Main Room

Alien Intelligence, Myth and Reality

With Frederic Siboulet, consultant (former Deloitte, EY & IBM)

Over the past three years, there has been a rapid acceleration in the role of artificial intelligence, particularly with GPTs and LLMs. We examine why, how, and where AI may be augmenting human performance in quantitative and operational tasks. We also consider how this new paradigm relates to model structures and data utilization, both during training and inference. In addition, we discuss the relationship between model size and model risk, and explore the potential evolution of data science given the new agentic frameworks available to businesses.

4:00pm - 4:30pm

Main Room

Uncorking Alpha: Data-Driven Strategies in Fine Wine Investing

With Tommy Jensen, Wine Capital Fund in conversation with Ciaran Ryan, Eagle Alpha

Data driven wine investing? Yes please. Join Tommy Nordam Jensen (CEO, Wine Capital) and Ciaran Ryan as they discuss Selection, Storage and Selling of tier 1 investment grade wines.

4:30pm - 5:00pm

Main Room

Drinks Reception

Wind down after the conference and connect with colleagues at our closing social gathering.

5:00pm - 6:00pm

Gallery

Invite Only Buyer Dinner and Networking

6:00pm

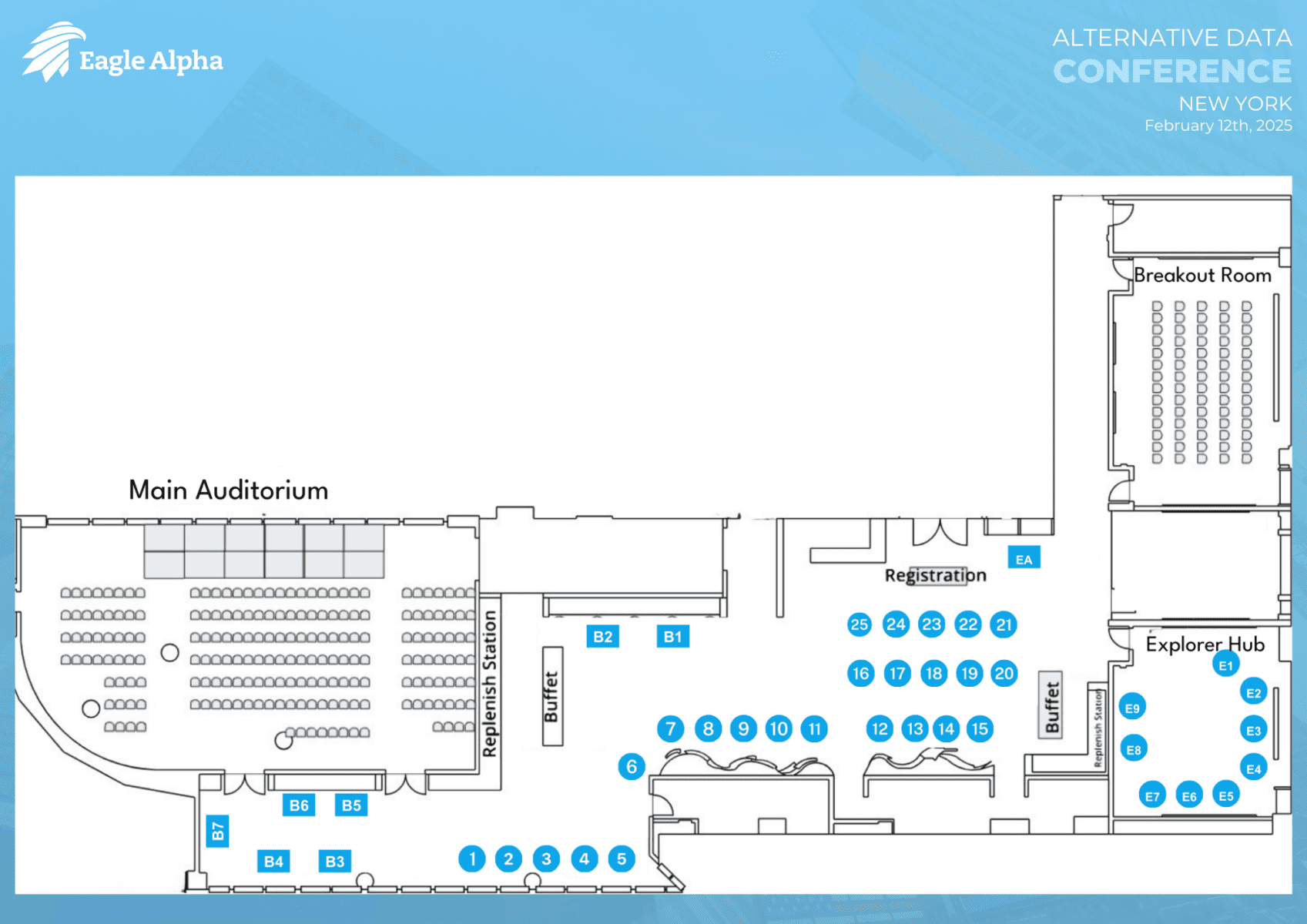

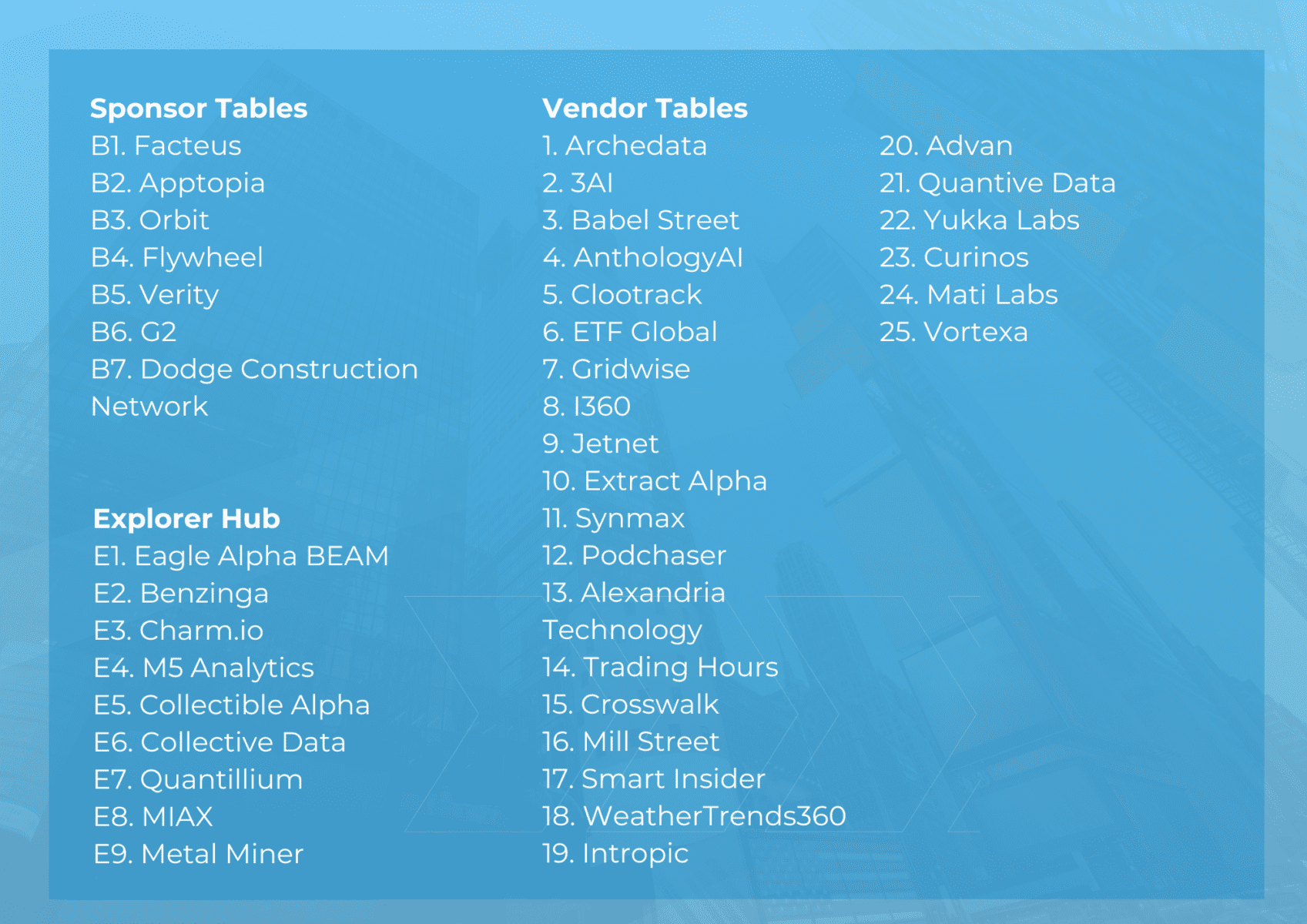

Venue Map & Legend